November 2023 - San Diego Real Estate Market Update

In a flash of great housing news, mortgage rates have improved over the last few weeks, and as a result, we are seeing an uptick in mortgage applications and homebuyer activity, all at a time of year where we would typically expect to see a slowdown due to the holidays. At the same time, we are seeing more inventory of homes for sale than has been on the market in some time, offering buyers more options. These two factors are adding up to a more favorable market for homebuyers. But sellers, not to fret! Home prices are continuing to hover near their all-time highs as new listings remain flat and the best homes still sell quickly at or over their asking price.

The improvement in interest rates that we’re seeing is a result of two meetings in a row where the Federal Reserve (the Fed) did not raise the federal funds rate, signaling that they may finally be done with rate hikes. The market reacted positively to this news. Q3 data on employment and inflation were both strong, making it seem more and more likely that the Fed will be able to achieve a “soft landing,” defined by bringing inflation back down to the target 2% without triggering a recession. Fed Chairman, Jerome Powell, was quick to point out, however, that we still have a ways to go in achieving 2% inflation, and the Fed will “not hesitate” to raise rates again if necessary in order to achieve that goal. Despite that comment, the common consensus is that the conversation of rates is now less about how high they will go, and instead, how long they will stay high.

Thus far, it seems the U.S. has managed to avoid recession, but experts have warned that it often takes 1-2 years from the time a fiscal tightening policy begins in order to trigger a recession, which means we could still see a recession in 2024. Many market analysts have gone on record to say that if we do, indeed, see a recession, it would likely be short-lived and minimally impactful compared to previous recessions. Given that student loans have resumed for tens of millions of borrowers and household savings rates are down while the average consumer debt is rising, it is plausible that household spending could dwindle in the coming months. Business’ spending was higher than expected in Q3, but is not expected to stay at that level in Q4. We have also seen increased government spending as of late. All of these factors will impact GDP, a lag measure, which ultimately determines whether we’re in a recession.

Even if we see a recession, a housing crash is highly unlikely as today’s homeowners are amongst the most well-qualified mortgage borrowers on record and have substantial equity in their homes. Over 90% of US homeowners have mortgage rates below 4%, 49% of homes in the U.S. have at least 50% equity, and 37% of homes are owned free and clear. This gives homeowners who may struggle to make mortgage payments in the case of a recession plenty of cushion to avoid foreclosure. In the absence of foreclosure, a spike in inventory of homes for sale that outweighs the considerable demand for home purchases is extremely unlikely - with no spike in inventory and drop in demand, there can be no “housing crash.”

Inventory of homes for sale has been on the rise, and we are now seeing inventory comparable to pre-pandemic levels. A “balanced” market is one where supply and demand are equally matched - in that case, we would see around 6 months of inventory, meaning it would take 6 months for all homes on the market to sell. Right now, we are still a long way away from that, and have been since 2015. New listings remained relatively flat in the spring and summer, but saw a drop-off in September. As we move through the fall and winter, it will be interesting to see if new listings continue their seasonal trend downward or if we see more activity due to high prices and improving rates.

We are seeing more price drops on homes that are listed, as well as more listings being pulled off the market without selling. With that being said, homes located in desirable areas that are “move-in ready,” and require little work are still selling quickly for at or over asking price. The homes that are lingering on the market and seeing price drops are primarily homes in less in-demand areas and homes that need work. In today’s higher interest rate environment, most buyers want a home that is “done.” When rates are low, buyers are able to put less money down on a home and reserve cash for renovations, or even finance their renovations, while still having a reasonable mortgage payment. Today, that’s not the case and as a result, home buyers are not willing to pay top-dollar for a home that will require additional investment. Homes like that will likely sell at a discount, be pulled off the market to renovate before re-listing, sell to a developer, or may wait for a more favorable time to sell when buyers don’t need to be as selective.

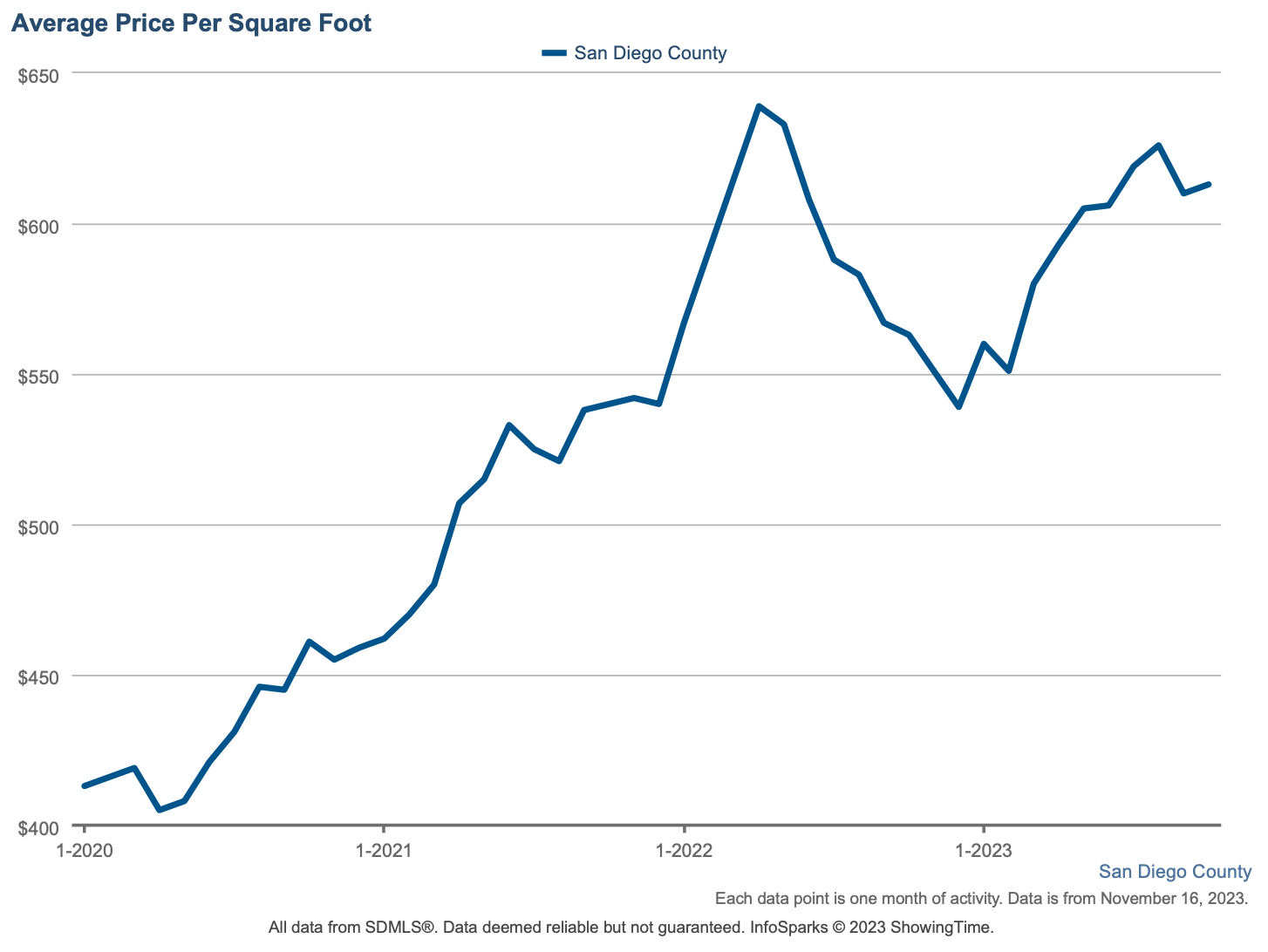

This dynamic is dragging down the average price a home sells for versus it’s original list price, as well as the number of days a home spends on the market and the median home price (the price at which half of homes sell for more, and half of homes sell for less). Median home prices are staying flat, but if you look at the average price per square foot, you can see that home prices are in fact still rising.

The U.S. housing market will face many challenges in the coming year as the Fed continues its fight against inflation, the presidential election heats up, all eyes are on recession watch and geopolitical tensions continue, but we expect for prices to remain high, interest rates to remain elevated and inventory to remain low in 2024. Watch out for our December market update, when we will discuss our expectations for the coming year.

WHAT DOES THIS MEAN FOR YOU?

If you’re a homeowner:

If you own a home and you’re not looking to move, ride the wave. You likely have substantial equity and a low interest mortgage that is manageable. The great news is that your home value is hovering near all-time highs. If you’re considering moving in the next few years, let’s talk about your ideas. If you’re considering remodeling or tapping into your equity, give me a call for lender referrals that can help you access the lowest rates available right now.

If you’re a hopeful homebuyer:

If you’re newly in the market or revisiting buying a home after choosing to wait out the market, we should talk sooner rather than later. Buyers have more power in the real estate market right now than they have in the last few years with sellers more willing to make concessions including rate buydowns, repairs and price reductions. Keep in mind, though, inventory is still low so there is still more limited selection and the best homes still sell at breakneck speeds. When you lock your rate for a home loan is very important right now as rates can change quickly and changes of even .5% can save you thousands of dollars per year in interest costs. Remember, you can always refinance a high interest rates, but your purchase price is forever. If you love a home, you need to take steps to secure it quickly.

If you’re a potential home seller:

If you’re interested in selling your home, it’s a great time to sell. Depending on the location and condition of your home, you may be able to sell at record value quickly. This is a tough market for buyers so it's important to keep that in mind when listing your home. The key to selling in this market is to price your home intelligently, make it as appealing to buyers as possible, market it strategically and come to the table ready to create a win-win scenario for both you and your buyer. This is my expertise and I’m never too busy for you or your referrals whether you’re considering selling or you just have questions about the market.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024