June 2024 - San Diego Real Estate Market Update

Despite sluggish home sales, San Diego tops the chart for home price appreciation across the U.S. With a 10.5% year-over-year growth, our beloved San Diego continues to shine as one of the hottest markets in the country. This should come as no surprise to those of us who live here and enjoy the countless benefits that make this area so desirable, from the beautiful weather to the vibrant culture.

That said, 2023 was the slowest year for real estate sales since the mid-90s, and this year isn't shaping up to look any different. As long as mortgage rates remain elevated, we will continue to see extremely restricted sales activity in the real estate market. It’s a challenging environment for buyers and sellers alike, and I’m sure many of you have felt this firsthand.

Mortgage Interest Rates

Mortgage rates have come down a bit over the last month, which has led to a moderate increase in mortgage applications and home sales. However, for the market to return to a more normal state, rates will need to drop significantly, likely to around 6%. We shouldn’t expect to see sub-5% rates return unless a greater crisis occurs, which would bring consequences far outweighing the benefits of low rates.

Currently, high mortgage rates are locking many sellers into their existing homes, where they hold low rates, and discouraging buyers due to high monthly payments. While we can anticipate rates will eventually decrease, the timing and extent remain uncertain. We might end the year with rates in the 6.5% range. When rates do hit the 6% mark, homebuyer demand will likely surge, heating the market once again. Those who purchased during these higher-rate periods will be in a favorable position to refinance and benefit from lower payments while locking in lower home prices.

Inventory of Homes for Sale and Homebuyer Demand

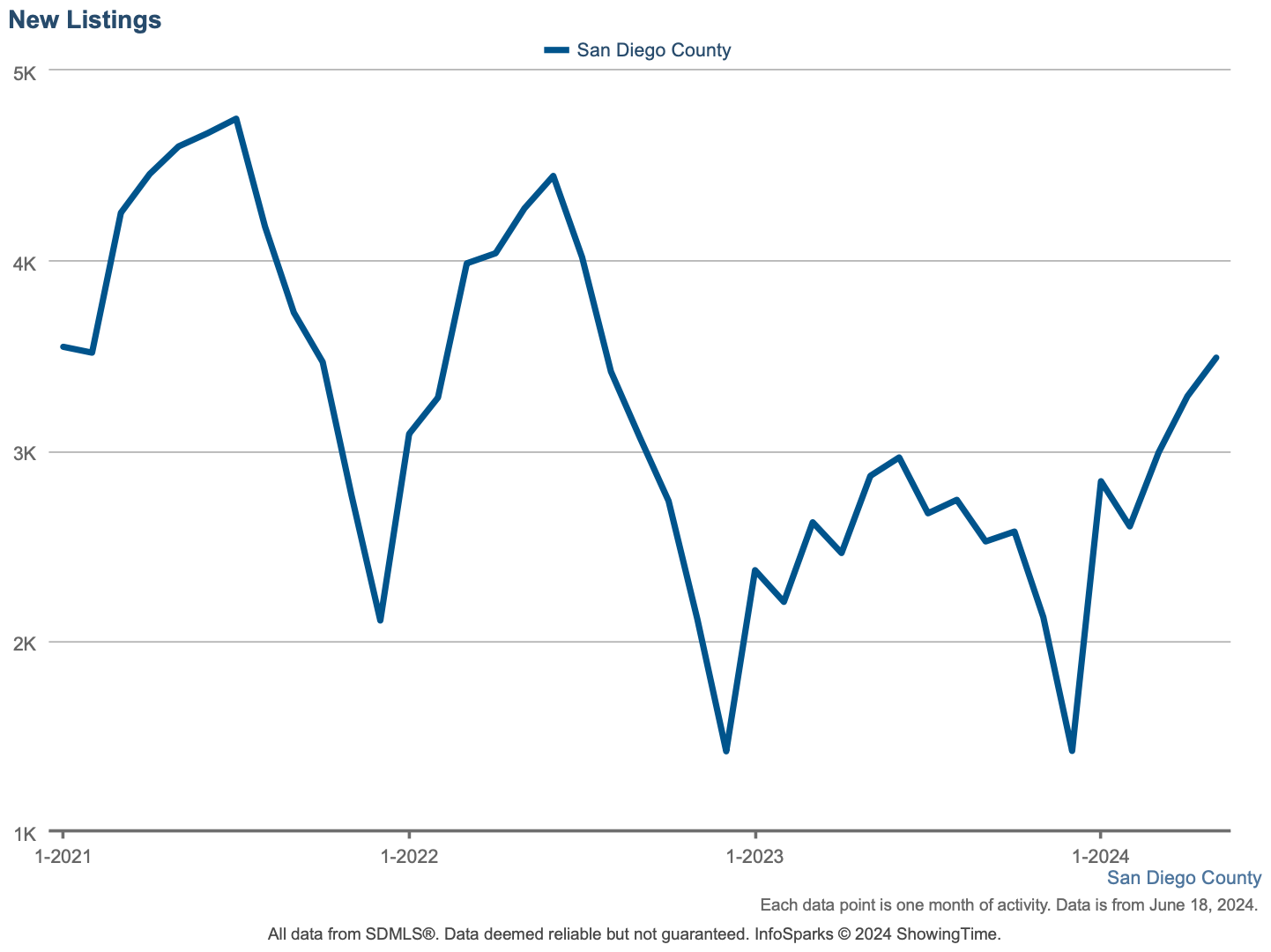

On the inventory front, the number of new listings hitting the market continues to rise but is expected to taper off soon. Active inventory is increasing as demand stagnates, however overall active inventory, even compared to today's demand, is still low in a historical context. Many homes remain unsold due to being overpriced, requiring work, or being located in less desirable areas. However, the most desirable homes are still selling quickly and often above the asking price.

We’re seeing fewer offers at more moderate price levels, with homes selling closer to their asking prices. This trend suggests that while demand for top-tier properties remains strong, overall market activity is more subdued. For those considering selling, it’s crucial to price your home realistically and make any necessary improvements to attract buyers in this competitive environment.

Home Prices

Home prices are still on the rise but are beginning to level off. We will likely see a slight decline soon, which is seasonally appropriate and nothing to be concerned about. Most homeowners have a very comfortable equity cushion and can sustain typical fluctuations in home prices. Historically, prices tend to level off in the late summer and early fall, drop over the holidays, and then rebound to surpass previous highs in late winter and through spring and early summer each year.

For buyers, this seasonal pattern means there may be opportunities to purchase homes at slightly lower prices in the coming months before the market heats up again, but that all depends on how rates impact prices. For sellers, understanding these trends can help in timing your listing to maximize your sale price.

Economic Outlook

The U.S. economy appears to be nearing an inflection point. After over two years of elevated interest rates aimed at combating inflation, we’ve seen significant improvements in controlling inflation. However, cracks are beginning to show in consumer spending and employment, which means the Fed needs to tread carefully to avoid triggering a recession.

So far, the Fed has managed a "soft landing," tempering inflation without harming the broader economy. If they wait too long to lower rates, we could see elevated unemployment and restricted GDP growth, posing a threat to the economy and impacting us all. On the other hand, lowering rates too early could risk a resurgence of inflation and a loss of public confidence, reducing the Fed's influence over economic direction.

It’s a delicate balance, and we’re getting very close to changes that will break the holding pattern we’ve been in for over a year. Whether these changes will be for better or worse remains to be seen, but one thing is certain: staying informed and adaptable will be key.

In Conclusion

Navigating the current housing market requires a keen understanding of these dynamics and a strategic approach. Whether you're buying, selling, or simply keeping an eye on market trends, it's essential to stay informed and flexible. If you have any questions or need personalized advice, don't hesitate to reach out. We’re all in this together, and I'm here to help you make the best decisions for your situation.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024