June 2023 - San Diego Real Estate Market Update

The volatility of the Southern California real estate market continues with trend reversals in May compared to April's downturns. In May, we witnessed several indications of market improvement. However, this pattern of volatility should be expected to persist due to ongoing market shifts that influence consumer behavior. These shifts can be measured even when they are relatively small due to the extremely limited housing inventory, which is the one market factor expected to remain unchanged.

In May, we observed an increase in new listings of homes for sale, more active listings, and a higher number of homes sold compared to the previous month. Additionally, there was an increase in the average price paid for a listing compared to its original list price. These positive indicators suggest an improved perception of the real estate market among homebuyers, or at least their acceptance of housing affordability and a determination not to let factors like high mortgage interest rates further delay their home search.

New listings coming to the market represent one of the more volatile elements of our current market as homeowners react to a myriad of market-related factors and navigate when to sell and when to hold off.

After a decrease in sold homes from March in April, May reversed that trend as more homebuyers closed on home purchases.

The number of active listings on the market has been climbing since March and we are seeing a trend of new homes that hit the market selling quickly if they are in located in great areas and are in great condition, but lingering on the market longer if they are less desirable.

The average percent of original sales price rising represents buyers' willingness to pay the list price or bid-up the price of a home.

Although homebuyers are moving forward with purchases, they appear to be proceeding cautiously compared to the buying frenzy witnessed during periods of sub-4% interest rates over the last few years. Homes are spending a slightly longer time on the market before going under contract, and buyers are viewing fewer homes before making offers. They are no longer considering just any home; instead, they are seeking the right home in the right area. Once they find it, they act swiftly. This approach holds wisdom. It is highly probable that mortgage interest rates will decrease in the coming months and remain in the 5-6% range in the long term, as long as the US economic outlook remains within normal market cycles. When rates decline, home prices are likely to rise more rapidly. By securing a property now that meets their long-term needs, buyers can secure an appreciating asset. Homebuyers utilizing a mortgage will also have the opportunity to refinance their loans when rates decrease.

Market time is down reflecting that homebuyers are moving more quickly than they have since last summer, but not nearly as quickly on average as they were before interest rates started climbing. This average also reflects that highly desirable homes are still selling quickly but less desirable homes are sitting on the market for quite a bit longer, whereas in 2021 and the first part of 2022, all homes were selling quickly, even those in less desirable areas and conditions.

MORTGAGE INTEREST RATES OVER TIME

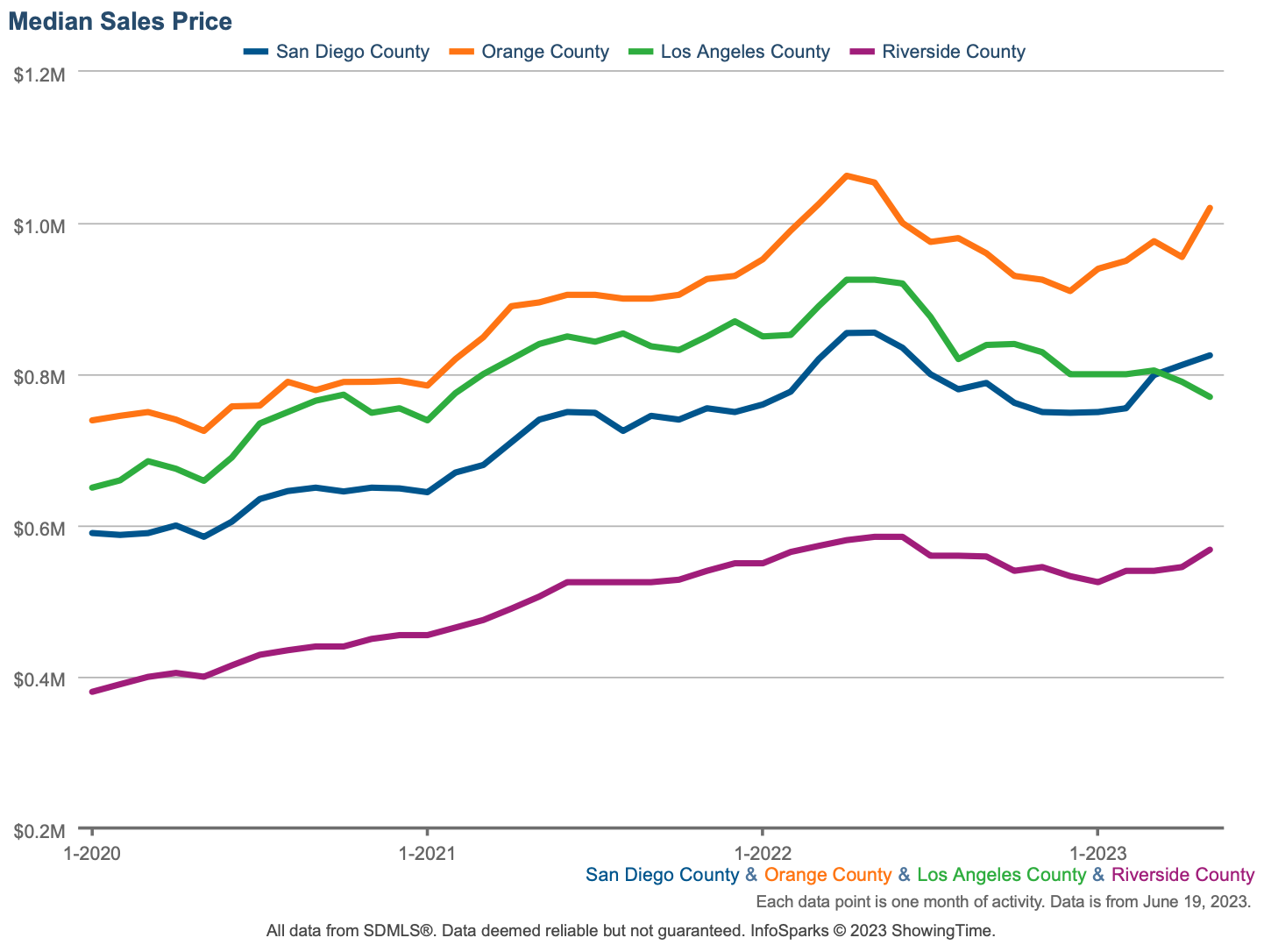

Typically, all Southern California counties follow a similar trajectory in terms of median home sales prices. Presently, while the fluctuations are relatively minor, only San Diego's total median sales prices have increased month-over-month. Interestingly, the median sales prices for detached homes and manufactured homes have increased across all counties, while the median sales prices for attached homes have either decreased or remained stable. This reflects a negative perception of attached residences compared to single-family homes. Overall, except for Los Angeles County, which exhibits greater volatility and varied market factors compared to other areas, median home sales prices are within close proximity to May 2022's all-time highs, with a decline of 2.9% to 3.4% compared to last year. This is great news for anyone who thought they had missed the opportunity to sell at top dollar and may explain the increase in new listings of homes for sale that we are currently witnessing. It is also reassuring for homebuyers who may have been concerned about a potential market crash and the risk of investing in properties that would not retain their value. While there will always be highs and lows, if home values rebound quickly from their lows, homebuyers can feel more confident about investing, knowing that they won't be stuck with a home whose value remains underwater for an extended period.

All Property Types

Average median sales price for all property types in the 4 most populous Southern California Counties.

Manufactured/Modular Homes

Demand for manufactured homes tends to fluctuate drastically.

Detached Single-Family Homes

Demand and therefore median sales price for detached homes remain the most stable.

Attached Homes - Condos and Townhomes

Demand for attached homes follow the trends of detached homes more closely, but when you compare the median home value trajectories, you can see that attached homes are less in demand for today's buyers than detached homes.

In the long term, numerous factors could unpredictably impact the real estate market. However, the relative constant on which the market hinges is low inventory, and it's difficult to imagine a scenario where inventory would substantially increase, especially in Southern California. Legislation such as capital gains taxes and Prop. 13 make selling a costly endeavor for many homeowners and makes the prospect of moving to smaller, single-story retirement-friendly homes less appealing. Additionally, low-interest rate mortgages have resulted in lower monthly payments for homeowners, reducing their incentive to sell. Furthermore, most homeowners hold significant equity in their properties, so even if market factors make it challenging for them to make mortgage payments, it does not pose a substantial risk to the real estate market in terms of an influx of inventory causing prices to plummet. In fact, if the US were to experience recessionary conditions, it is likely that the Federal Reserve would utilize interest rate decreases as a tool to stimulate the economy. This would likely lead us back to a situation of high housing demand, similar to what we witnessed in 2020, and would result in rising home prices.

WHAT DOES THIS MEAN FOR YOU?

If you’re a homeowner:

If you own a home and you’re not looking to move, ride the wave. You likely have substantial equity and a low interest mortgage that is manageable. The great news is that your equity losses from May 2022 - December 2022 are rebounding as we move through this year and it is unlikely that you will see substantial equity losses in the near future. If you’re considering moving in the next few years, let’s talk about your ideas. If you’re considering remodeling or tapping into your equity, give me a call for lender referrals that can help you access the lowest rates available right now.

If you’re a hopeful homebuyer:

If you’re newly in the market or revisiting buying a home after choosing to wait the market out for a while last year, we should talk sooner rather than later. Buyers have more power in the real estate market right now than they have in the last few years with sellers more willing to make concessions including rate buydowns, repairs and price reductions. Keep in mind, though, inventory is still low so there is still more limited selection and the best homes still sell at breakneck speeds. When you lock your rate for a home loan is very important right now as rates can change quickly and changes of even .5% can save you thousands of dollars per year in interest costs. If you love a home, you need to take steps to secure it quickly.

If you’re a potential home seller:

If you’re interested in selling your home, it’s a great time to sell. If you felt like you missed your peak price last Spring, you're well on your way to recovering from that loss. Your home has earned you substantial wealth over the last three years. The key to selling in this market is to price your home intelligently, make it as appealing to buyers as possible, market it strategically and come to the table ready to create a win-win scenario for both you and your buyer. This is my expertise and I’m never too busy for you or your referrals whether you’re considering selling or you just have questions about the market.

Most importantly, if you have questions or concerns about your specific situation… CALL ME to help sort through them. That’s why we get up in the morning - not just to sell homes, but to serve our clients.

As always, we will be here to continue to provide you with updates about the housing market and answer any and all of your questions. Feel free to reach out to us anytime.

HOMEOWNER RESOURCES:

FUTURE HOME BUYER RESOURCES:

Say Hello

Get in Touch With Us

301 Santa Fe Drive Ste B, Encinitas, CA, 92024